Some Ideas on Your Renters Insurance Guide - Iii You Should Know

Just how can occupants lessen the chance that an insurance claim will be refuted? They will certainly want to read the plan papers carefully to make certain they recognize the exemptions.

Flooding creates very costly damage, since the water has lots of bacteria as well as particles once it makes it inside a house, as well as it will certainly harm essentially whatever it touches. renter's insurance. Quakes aren't a lot better; tragic architectural damage can indicate that there's no possibility of fixing as well as just the alternative of taking down the building totally and also beginning again.

Some protection for earthquakes and sinkholes might be offered as "add-on" coverage for an extra cost in locations where those dangers are prevalent, and flooding insurance is readily available for separate buy from the National Flood Insurance Program for tenants who live in flood-prone locations. Does occupants insurance coverage cover water damages! - affordable renters insurance.?. !? It can, however it generally just covers damage resulting from mishaps or pipe breakage in the residence or water that is available in due to harm to the roofing system.

Terrorism is additionally excluded from most plans for similar reasons. renters coverage. It's a wide term that can put on large or little occasions and also is impossible to predict, but it might create damages to a large area all at once. This exclusion will dismay several tenants (renters insurance). Damage triggered by bugs such as bed insects, termites, computer mice, and various other vermin is typically excluded from renters insurance coverage.

Some business will permit a shared policy, but in that case, both tenants should be detailed on the plan as well as a made a list of listing of ownerships need to come with the policy. affordable coverage. Even then, it's typically best for roommates to acquire their very own rental insurance coverage to stay clear of disputes after a catastrophe has happened - renters.

So if a backpack including a laptop is stolen out of a parking area at the workplace, occupants insurance coverage will cover the substitute of the taken items after the deductible has actually been satisfied. The vehicle isn't covered in and also of itself; any damages to the automobile, or loss of the whole car, would certainly be covered by vehicle insurance coverage.

What Does What Does Renters Insurance Cover? - 2022 Guide Mean?

Where home owners insurance policy includes insurance coverage for the structure of the building, the premises, the appliances and home systems, and also the contents of the home, renters aren't responsible for all of those points. That's why renters obligation insurance as well as personal effects insurance coverage does not cover damages to the residence structure itself.

price affordable coverage renters damages coverage

Mold and mildew falls under 2 of the groups that are reasons for exemption from renters insurance coverage: it's usually brought on by an upkeep concern, as well as it's often brought on by flooding - liability. Mold isn't usually brought on by a sudden event, since it grows over time as well as is rather costly to remediate as well as repair. For that reason, mold damage is generally not covered by tenants insurance policy.

If the mold and mildew damages is the result of a covered event, such as a burst pipeline or tornado, the renters insurance plan may cover replacement of harmed or destroyed things (coverage). The ideal method for tenants to stay clear of paying of pocket to change mold-damaged items is to report any type of leakages or feasible water damage to their landlord to fix the problem immediately, consequently stopping mold and mildew from creating to begin with.

If a pet chews the legs of a table or a feline scrapes up the arms of a sofa, the animal proprietors will certainly be making the fixing out of their own pocket. The same opts for carpets that are dirtied (rental). In a similar way, unintentional damages caused by human beings is normally not taken into consideration a covered risk.

Renters insurance policy plans have protection restrictions, as do all insurance plans. The overall payout limitation will be detailed in the policy documents, and also depending upon the insurer, might be limited per case, per thing, per event, or per year (renters). This amount is generally high enough to supply standard individual residential property insurance coverage and also obligation insurance.

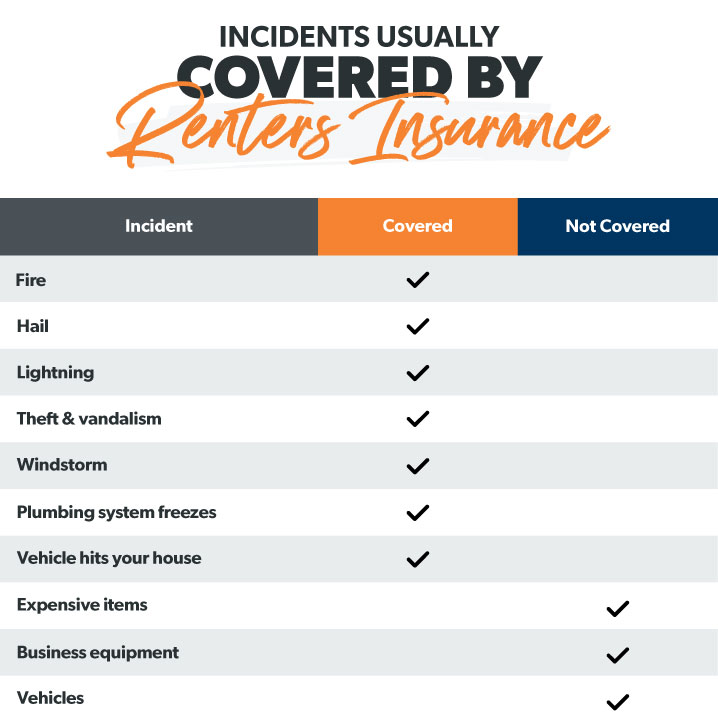

A stock can help an insurance representative aid occupants in identifying just how much coverage they need. There are specific scenarios that will certainly generally call for additional coverage. The very first is if the tenant has products of high value, such as antiques, music instruments, antique items or furniture, jewelry, and various other products whose substitute worth would certainly surpass the regular insurance coverage limit (water damage).

4 Simple Techniques For Renters Insurance Guide: Everything You Need To Know

options property management home insurance rental insurance liability

The second circumstance is if the tenant owns a tiny business that is run out of the rental unit. The equipment that is used especially Great site for business is not covered by the routine occupants policy, but like the high-value product recommendation, a lot of business have an organization endorsement that can be included in a plan so the renter is fully covered (affordable renters insurance).

coverage property cheaper renter's affordable renter's insurance

damages rental insurance renters options low cost

For useful things that no more have documents, such as heirlooms, older jewelry, or collections, tenants can speak with experts for an appraisal record and also do the same with that said details. Also pictures of the model and serial numbers of electronics can assist when suing - insure. Documents enhances the claims process, and also asserts gone along with by cautious documentation raising less concerns and also obstacles and also are most likely to be paid out without delay.

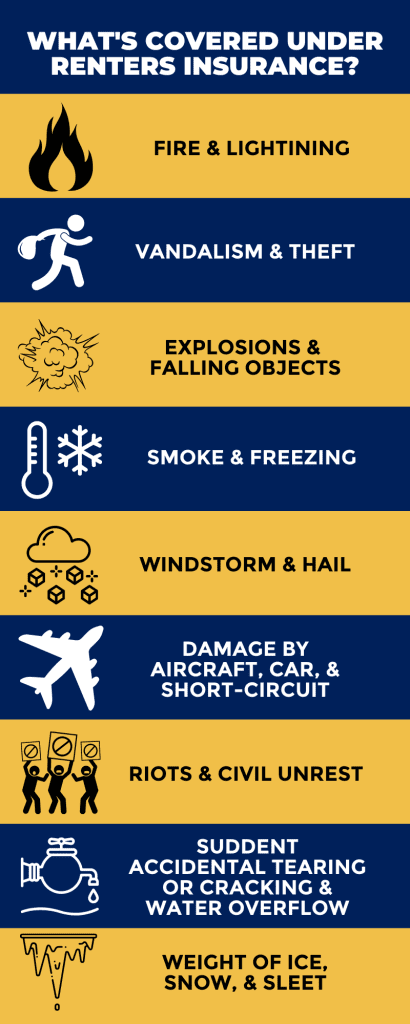

What is occupants insurance coverage used for? Fires; windstorms; rain, snow, as well as hail damage; lightning strikes; ruptured pipelines; surges; vandalismthose hazards are normally covered and also are the most likely reasons for substantial financial loss. lease. Does tenants insurance cover burglary!.?. !? It does, as well as it will likewise cover damages triggered by the robbers while they're inside the home.

https://www.youtube.com/embed/HS5Y-ownT_0

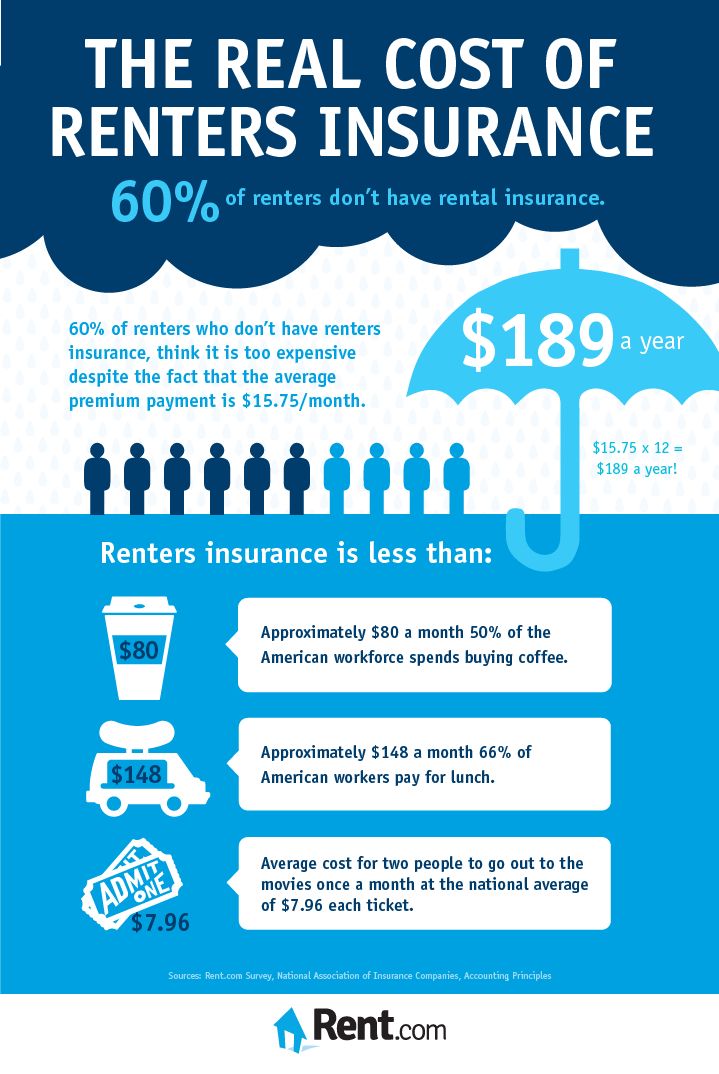

Renters can shop around online as well as get a practical idea of the replacement price of their items (price). Many renters might find that the cost to change their individual items after a calamity isn't a quantity they have actually conserved up or would want to put on a bank card to change. cheapest.